3 Questions That Will Change The Way You Save Money Forever

Saving money is so easy a cave man can do it right? But, what if I told you 90% of Americans don’t save money SMARTLY? You know anyone can save their money but only a select few save their money in a way that will prosper them in the future.

Today I am going to start you down the path of how to save your money smartly by getting you to think about 3 questions. The first one is…

Questions 1 To Save Money: Do You Think Taxes Are Going Up Or Down In The Future?

This one question we could debate on for days and never come to a definite conclusion. There are opposite sides of the equation and each has very persuading arguments. Which has made me, and I imagine thousands of others, want to bang my head against a wall.

My clients live all over the world and come from all walks of life. Their jobs range from tax accountants to teachers, from lawyers to longshoremen. Many own their own business in a myriad of different industries. But, without fail, every single one of them has answered question 1 that they think their tax bill is going to be more in the future.

If you think the same then you can start to narrow down the ways that make sense on how to save smartly.

You would be shocked at how many people tell me they think that taxes are just going to keep going up then decide to save in a 401(k) or IRA or whatever. If you truly believe that taxes are going up then you should never think about investing in these things because you will LOSE more money in the future rather than paying taxes now!

Honestly, I don’t understand how there can be such a mental disconnect. (sigh) But, if there wasn’t a disconnect I wouldn’t be in business and you wouldn’t have the amazing opportunities that exist because 90% of Americans aren’t being smart with their savings.

So, the thing to remember while you consider question 1 is: do you save money in a way that is congruent with what you know?

Question 2 To Save Money: Tell me in what order you’d rank these four categories in terms of the most desirable types of money to receive as income.

Now we will start to get into the different categories of saving money. Understand this section and you will have the ability to spot an amazing savings opportunity when you see it.

The second question follows: “Let’s look at the Tax Advantage Table. Please tell me in what order you’d rank these categories in terms of the most desirable types of money to receive as income.”

1) Taxable money

2) Tax-free money

3) Free Money

4) Tax-deferred money

These categories are extremely important when considering how to save your money. The reason these categories are important is that savings aren’t just about the money you put away but about what kind of expenses come with putting your money into certain accounts.

Let me give you an example: You find a bank you can put your money and they promise they will keep your money safe. You may put as much or as little as you want into it. But, whenever you decide to take money out they will take a fee. So you decide to put $1,000 dollars into the account. A year goes by and you want to buy that fancy new scooter that costs $1,000 dollars. So, you walk into your new savings bank and ask them for your $1,000. But, to your surprise, you find that they take $300 dollars for just holding your money. (hmmmmm…..we are starting to see why we don’t like Uncle Sam.)

This example is known as taxable money. And yes it is a bit extreme but you get the point. 100’s of 1,000 of Americans save like this, where they believe they save money…which is true. But, they could skip the “fees”, aka taxes, and save money in ways that don’t require you to pay taxes.

No, I am not advocating tax evasion. DON’T DO THAT!

What I am saying is understanding the different ways to save can “save” you a lot of money. (Yes pun intended 😊)

Here’s how I imagine most people would put the list:

1) Free Money

2) Tax-free Money

3) Tax-deferred Money

4) Taxable Money

Again, everyone I have ever spoken with puts them in the order listed above. They all agree that free money is better than tax-free, tax-free is better that tax-deferred (and honestly, who doesn’t love free money?!), and tax-deferred is better than taxable money.

Let’s assume for a minute that you put those 4 categories in the same order. Now let’s drill down exactly the types of things that fall under each of those categories that way you can save money smartly:

1) Free money: gifts, inheritance, life insurance death benefits, and 401(k) MATCH (only the match portion of the 401 is free)

2) Tax-free money: ROTH, municipal bonds, Cash Value Life Insurance

3) Tax-deferred: 401(k), IRA, SEP, Simple, 403B, SEP, TSP

4) Taxable money: Stocks, Real Estate, Mutual Funds

Now, look at the types of accounts you have invested in to build your wealth, or to save money for retirement. This is where it gets interesting.

We all can hope for some money from category #1, but we don’t really have much control over that – whether or not we get a gift, inheritance, or match for our 401(k) contributions is largely up to other people or grandma.

The next best thing we can invest in are those things listed in category #2. But although most Americans agree in the order of categories, they invest their money in the #3 category almost always, skipping over the #2 category entirely; and I have never understood that.

Question 3 To Save Money: Would you draw money from a taxable account or a tax-free account?

Now for question 3:

There are only 2 types of “buckets” we can draw money from during retirement: taxable and tax-free. Which would you rather draw from? I’m guessing you said tax-free…if you didn’t please try again and answer that question saying “tax-free”. 😉

Let’s take a closer look at the things that fall in each bucket:

Some of these are great investments, and all have their place, but all of these investments are subject to either capital gains taxes or ordinary income taxes. And where do you think most people have the majority of their retirement accounts stationed? Yep, you probably guessed it. Most people, before meeting with me, have saved their money in a 401(k).

So, if you are required to pay taxes when you take the money out for retirement, and you believe that taxes are going up – in other words, you’ll be paying more taxes on a larger amount of money – do you really think you’re going to save money on taxes in a 401(k)? If you do you need to get your head checked.

But there is a better option. Let’s look at the items in the tax-free bucket in our infographic below.

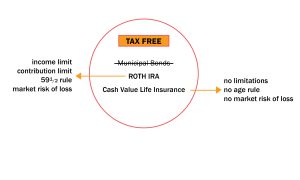

Municipal bonds aren’t right for most folks for many reasons, so we are going to toss this one out which leaves 2 choices in this category: ROTH IRA accounts and Cash Value Life Insurance. Both of which when I first mention them I find people are a bit wary.

The ROTH IRA is a fantastic vehicle, and I encourage almost every client to have one. But there are some constraints you need to be aware of, including income limits, contribution limits (usually $5,500), IRS penalties for pulling money out before age 59 1/2, and risk of loss of your principal since ROTH’s are almost always tied to mutual funds. What a headache!

Finally, there is Cash Value Life Insurance. Almost all of my clients prefer this option because none of the limitations of the ROTH apply in these types of accounts. No income or contribution limits, no age penalty, and no market risk for your principal! Sounds great huh?

Conclusion

In the end, you are the one to make your own decisions. You now have the knowledge of what most Americans do to save money and understand why you should do something differently. I’m here to help if you would like just give me a call using that number in the button of the menu.

I’d love to hear from you. What other investments do you think fall into these other categories?

Leave a Reply

Want to join the discussion?Feel free to contribute!