Time and Inflation Tend To Destroy Retirements

Few people realize the power of time and inflation. Especially when it comes to wealth creation these powers can either be a power propelling you forward, or a force pushing you backwards. Either the ignorance of these powers or the willful procrastination of them can be fatal flaws to which many fall victim.

Assuming you just don’t appreciate the power of time let us review a three points.

First, you are or should be familiar with the rule of 72. Simply put if you divide 72 by your rate of return the answer will be the number of years it takes for you money to double in value. Let’s say you have a 7.2% rate of return, then your money doubles in 10 years. (i.e. 72/7.2 = 10).

But here is a surprise few planners actually talk about: although you have twice as much money is it worth twice as much? Let me say that another way. Today you have $10,000 and in 10 years you would have $20,000. Is that $20,000 worth as much in 10 years as it would be worth today? (In terms or purchasing power.)

Which brings us to the second point: Inflation. Anyway you look at it or at any rate, inflation is a head wind to your wealth building goals. Your investment won’t be worth twice as much at the end of those periods because of inflation. So we have to use inflation-adjusted or “real” returns. Technically, real returns = (actual return – inflation) divided by (1 + Inflation), but for most projections, it’s OK to use the approximation of (actual return – inflation). If the actual return of a portfolio is 7% and inflation 3%, the real return is approximately 4%. So dividing into 72 means it would take 18 years to double.

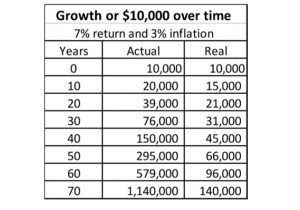

So let’s use an example actual return of 7% with 3% inflation to understand the importance of time to grow our investments and inflation. The attached table illustrates the actual and real growth. Real growth is meant to represent the future purchasing power in today’s dollar values.

Inflation has a large affect on what we think we will have in the future!

Third, with these two powerful forces working constantly it should become apparent how tragic it is to lose money. We have been assuming your rate of return is an actual rate of return, not an average rate of return. When planning for the future a down year can have the same affect as losing several years or experiencing higher inflation.

The keys to retirement financial success are: (1) start early and review often, (2) Save more than you think you will need, and (3) include substantial inflation-beating investments that will not be affected by down stock markets.

What we have found that people can save a whole lot more by identifying and eliminating unnecessary losses in wealth along the way. We believe the best strategy to employ is learning to Be Your Own Banker or sometimes called the Infinite Banking Concept.

Leave a Reply

Want to join the discussion?Feel free to contribute!