Admitting The Real Rate of Inflation Would Cause Serious Market Trauma

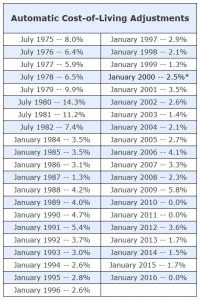

Many American have been hoping for a decent, might I say honest, cost of living adjustment (COLA) in Social Security. Those hopes we completely dashed recently when the Social Security Administration announced the increase for 2019 will be a whopping 0.2%. That’s two tenths of one percent. That will certainly keep up with higher healthcare costs and higher rent or property taxes and higher food costs. Really? That isn’t really an increase. This announcement comes on the heels of a 0% increase for 2016. The chart below shows ALL the cost of living adjustments since 1975. You will see from 1975 to 1982 there were astonishing increases. That was because we were dealing with serious inflation at the time. There were only two more times from 1982 to the present that Social Security sought fit to give cost of living increases of more than 5 percent. 1991 was 5.4 percent and 2009 was 5.8 percent.

The COLA is supposed to keep up with inflation. But the reality is, like so many other government provided statistics, far from what is reported. Charles Hugh Smith over at the “of two minds” blog recently made a case that inflation for the past several years has been 7+%. In fact Unbiased private-sector efforts to calculate the real rate of inflation have yielded a rate of around 7% to 13% per year. Ed Butowsky claims the inflation rate is 10x what is being reported. This has been going on while wages have stagnated.

What would happen if for some reason there was an official statement revealing the true inflation rate has been 7%? Here are a few possible consequences: (Keep in mind the immediate consequences to Social Security, interest rates and the cost of refinancing government debt.)

1) The Baby Boomers, the largest age category in the United States and therefore as a block the most powerful voting force, would immediately demand increases to their Social Security. They are some of the first to have paid into the system their whole life, so they feel like they own the system. Where would the government get the money for increases? From people who have money or from those who are already broke?

2) Investors, both foreign and domestic would probably want a yield on government bonds to be raised or at lease keep up with inflation. Now there isn’t much political power these investors can wield, but if they started to sell Treasury notes in mass look out below. But believe me any new issue Treasury notes would have to have a rate to at least keep up with inflation.

3) Likewise any new issue corporate bonds would have to have similar yields. Can you say major slow down in corporate growth?

4) Private sector borrowing would also be slowed way down. Borrowing for homes, cars, vacations, and education would suffer tremendously.

All of these scenarios point to one thing, and here it is: People will be able to count on getting their Social Security checks. People should NOT depend on their Social Security keeping up with inflation. Who will provide that lost income and how will it be done in a zero interest rate environment? If you really think about it, only insurance and financial advisors will be able to make up that difference.

Leave a Reply

Want to join the discussion?Feel free to contribute!