LESSON FROM FEDS FINANCIAL TAKEOVER OF PUERTO RICO? BE YOUR OWN BANKER.

Fox News recently reported: “For the first time in Puerto Rico’s history as a U.S. territory, the island doesn’t have the ultimate control of its finances.” Yes you read that correctly, at the end of September, a seven member control board appointed by President Barack Obama and the Congress took control of Puerto Rico’s finances and several government agencies. Why? They are trying to get the island territory out of what is described as an “acute” economic crisis.

What is the cause of this unpopular move? Puerto Rico has been mired in a decade-long economic slump brought about largely by decades of heavy borrowing. Puerto Rico was offered the chance for a lot of “cheap” money and they borrowed more than they can handle. This board, according to reporter Danica Coto, ” took over the island’s central government, its largest public university, its heavily indebted utility companies, a Government Development Bank that is running out of cash and a public pension system underfunded by more than $40 billion.”

Those who are awake will notice the stark similarities between this Puerto Rican takeover and the EU takeover of the Greek government. Sure, the smaller entity, i.e. Puerto Rico and Greece, should have not borrowed so much money. But because they did the larger entity, i.e. EU and the US, is stepping in to correct the course by edict. It will be painful for Puerto Rico as it has been for Greece.

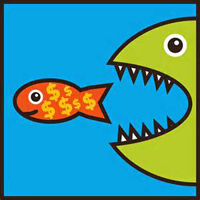

What can we learn from Puerto Rico? Individuals and small businesses (small entity) are in a similar position. You are being offered a whole bunch of “cheap” money by your local commercial bank or even your stock broker (Larger entity). These large entities are your best friend when the economy is humming along, but when a crash occurs they will seize your assets and shut you down. Achieve financial independence by learning how to “be your own banker.”

We live it, we teach it, let us help you to do the same….Let the awakening begin.

Leave a Reply

Want to join the discussion?Feel free to contribute!